As we mark the three-year anniversary of the Schroder International Selection Fund BlueOrchard Emerging Markets Climate Bond[1] , we take this opportunity to reflect on the steady progress made throughout this remarkable journey. From its inception on 17th of June 2021, the fund has navigated the dynamic landscapes of both global and emerging markets with the objective of delivering robust risk-adjusted returns, while driving meaningful impact by helping to advance the United Nations Sustainable Development Goals (UN SDGs) of taking action to combat climate change. The track record of consistent performance, even amid the complexities of the global financial markets – including challenges such as COVID-19, Russia’s war in Ukraine, and persistent, sticky inflation seen across major economies worldwide – stands as a testament to the fund’s resilience.

The Fund’s Strategy for Delivering Attractive Risk-Adjusted Returns

Our investment strategy, which focuses on aiming to deliver attractive risk-adjusted returns, has proven to be both rewarding and resilient, demonstrating the value of our rigorous approach to investment selection and risk management. Our active duration management and low volatility supported the Fund’s performance over past years. Furthermore, the fund’s defensive positioning, reflected in its BBB+ rating, and a lack of exposure to economies affected by Russia’s war in Ukraine, has allowed it to outperform wider EM indices in periods of unfavourable market conditions (source: JP Morgan; Schroders).

The Expanding Universe of Labelled Bonds

The universe of labelled bonds (including green, sustainable, and sustainability-linked bonds) has seen significant expansion over the past few years[2]. In Emerging Markets, labelled bond issuance totalled $68bn in 2023, marking an increase of over four times from the $16bn recorded in 2018. In terms of allocation, labelled bonds accounted for almost 30% of EM bond supply in 2023, a significant rise from the 4.7% share in 2018 (BofA Global Research – EM ESG, 2024). The increasing diversity among issuers, in terms of both geography and sector, has provided us with a wider array of investment opportunities. We have been able to leverage this expanding universe to enhance portfolio diversification and manage risk more effectively. The growth of the labelled bond market is a testament to the increasing recognition of the importance of sustainability and the rising investor demand for such instruments. As more issuers come to market with labelled bonds, we are presented with a broader choice of investments that align with our fund’s objectives and our investors’ values.

Navigating Market Dynamics: Adaptive Nature of Our Investment Strategy

We believe that the size of the universe plays a key role in the fund investment management strategy. Increasing the size of the opportunity set offers options to the portfolio manager to adapt to different environments. However, more than the number of issuers, one should think about how different each investment option is. Our definition of Emerging Markets, which includes any issuer having a positive impact in Emerging Markets’ countries, allows us to have access to very different issuers. While we can position the Fund very defensively by buying AAA supranational bonds, we can also increase yield by taking idiosyncratic risk in high-yield EM corporate issuers. Moreover, our flexibility to hedge interest duration or fully screen off a specific political risk allows us to position the Fund directly based on our market view. Strict risk constraints, coupled with active portfolio management, have allowed us to manage downside risk and improve risk-adjusted returns.

A Case Study – The Sustainability Journey of Chile and CMPC

To highlight some of the fund’s investments, we present the case study of Chile. Chile has established itself as a global leader in addressing climate change, underpinned by its ambitious Climate Change Framework Law. This legislation not only demonstrates the country’s commitment to environmental sustainability but also serves as a cornerstone for its proactive approach to climate-related issues (WRI[3], 2024). This aligns perfectly with the objectives of the Fund, highlighting Chile’s pivotal role in impact finance. The country actively issues a variety of labelled bonds, including green, sustainability, social, and sustainability-linked bonds, showcasing its pioneering spirit in embracing and promoting sustainable investment practices. Chile’s high credit rating, consistently rated in the single A area by all three rating agencies, offers several benefits to the portfolio. As a sovereign issuer, the bonds are liquid instruments and the issuer is active across various durations, allowing for diversification of the fund and enhancing risk-adjusted returns. In our view, the country’s issuances are expected to outperform traditional Emerging Market hard currency bonds in a downturn.

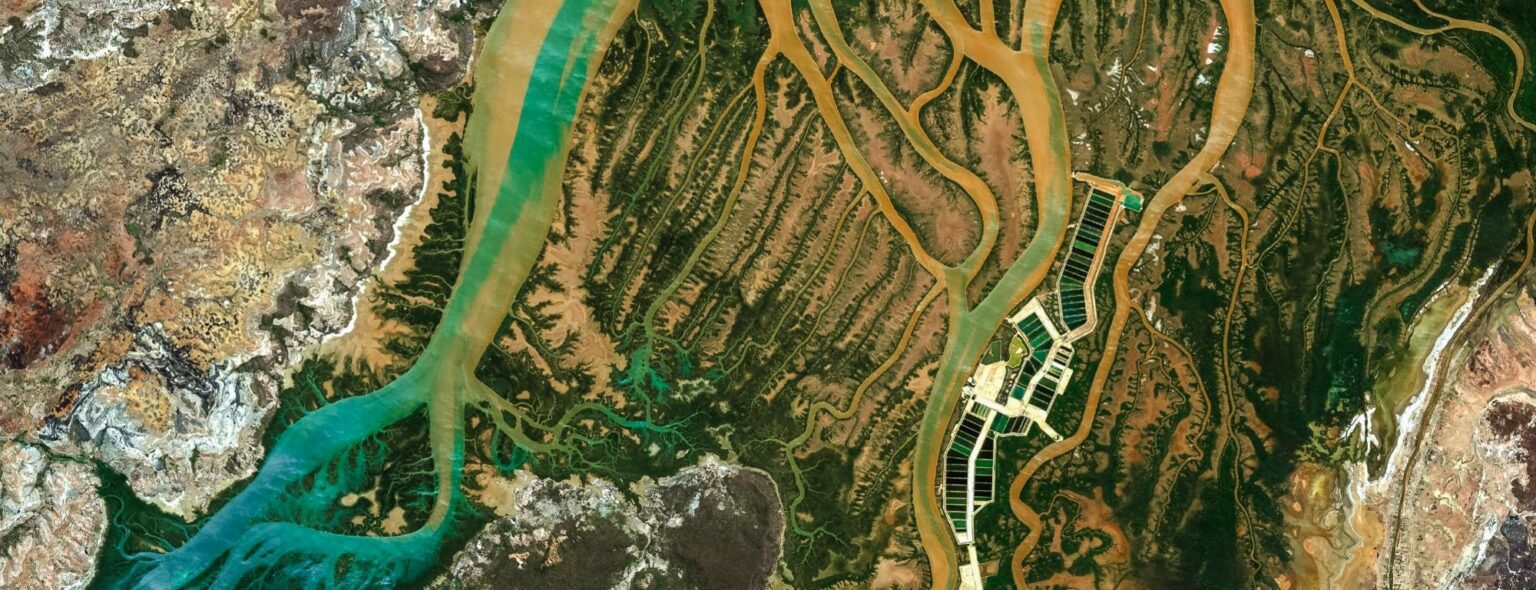

Additionally, the fund has invested in CMPC, a Chilean pulp and paper company. CMPC was the first Chilean company to issue a green USD bond in 2017[4] and has continued to issue several labelled bonds in subsequent years. Use of proceeds include the preservation of biodiversity and restoration of forests, and sustainable forest management, among others. CMPC’s competitive market position and efficient cost structure contribute to its ability to generate attractive operating cash flow, even during market downturns.

In 2023, strengthening its innovative leadership in sustainable finance, the firm issued a new and innovative CMPC bond mixing existing ICMA standards, known as Green & Sustainability-linked bonds (GSLBs). These bonds offer a well-defined use of proceeds that are ring-fenced, along with sustainability-linked impact targets that can be tracked over time with a financial incentive for the issuer to strive towards achieving these sustainability targets[5]. This new type of bond represents a welcomed addition to the suite of labelled bonds, combining the benefits of clearly defined use of proceeds with the ability to monitor and incentivise sustainability-linked impact targets, while remaining within the realm of well-recognised frameworks.

CMPC’s GSLB is primarily focused on sustainable management of natural resources and land use, with key sustainability-linked indicators targeting 50% GHG emissions reduction by 2030. The green tranche focused on eco-efficient and circular economy adapted products, as well as the development of Water Recovery Plants[6].

Maximising Impact: Listed Debt and Best Practices in Impact Investing

Investing in listed debt can have a significant impact, both in terms of scale and democratisation of impact investing. Companies such as CMPC issuing listed debt have the ability to undertake large-scale projects that can create meaningful change while still being able to report detailed quantitative impact indicators.

Public markets can absorb large-scale investments, hence the capability of public markets to attract a significant amount of global assets for impact investments. Moreover, investors in listed debt have access to smaller investment minimum requirements that can be redeemed typically daily, opening up impact investing to retail and smaller investors. This accessibility makes impact investing more inclusive, enabling a wider range of individuals to participate in financing projects with environmental and social benefits.

In the past few years, doubts regarding the feasibility of measuring impact in public markets have been effectively addressed. The industry has made significant progress in developing powerful tools for measuring and managing impact of listed debt strategies. Today, investing in listed debt offers an even stronger alignment with impact investing principles.

Additionally, investing in listed debt provides a strong alignment to impact investing principles, and its three pillars: intent, contribution, and measurement. The International Capital Market Association (ICMA)[7] promotes best practices and standards in the global capital markets and plays a significant role in the labelled bond market by providing guidelines and principles for issuers to follow when issuing green, social, or sustainable bonds. This helps ensure transparency and credibility in the market.

These bonds have defined eligible use of proceeds, which allows impact investors to determine whether the impact intent and planned use of proceeds align with their own impact objectives at the issuance or due diligence stage. This ring-fencing element also enables investors to finance specific impactful projects from a company or country.

Engaging with issuers to share advice and enhance impact outcomes along with mitigating sustainability risks represents one of the forms of investor impact contributions and additionality available in this asset class.

Furthermore, these bonds align with impact investing through their impact reporting requirements as they disclose pre-defined impact key performance indicators (KPIs). After one year of issuance, impact and allocation reports are disclosed, presenting the bond’s actual impact KPIs. This ensures the measurability component of impact investing is met and helps investors evaluate the level of impact they can have, both at investment and fund levels and to calculate their contribution to the SDGs.

At BlueOrchard, our B.Impact Framework process and tools are specifically designed to leverage such impactful instruments. Our robust impact calculation methodology also allows us to confidently report the impact our funds are generating through their investments. Additionally, the framework also ensures compliance with new regulations such as the Sustainable Finance Disclosure Regulation (SFDR) and the requirements of Article 9 funds. We have taken great care to align our process to comply with the regulation, by building strong in-house knowledge and expertise.

With our robust processes and tools, we are confident that we can continue to claim SFDR Article 9 status in the future. BlueOrchard’s commitment to excellence in impact management has been recognised as part of the independent verification of alignment with the Operating Principles for Impact Management (Impact Principles). The verification was done by the independent consultant BlueMark, scoring advanced and achieving the best assessment on all eight principles, positioning BlueOrchard on BlueMark’s 2024 Practice Leaderboard[8]. This recognition underscores the effectiveness and excellence of BlueOrchard’s impact management processes.

Closing Thoughts: Navigating the Next Chapter of the Schroder ISF BlueOrchard Emerging Markets Climate Bond

Schroder ISF BlueOrchard Emerging Markets Climate Bond has demonstrated resilience and adaptability over the past three years, successfully navigating complex global financial landscapes while delivering robust risk-adjusted returns. By leveraging an expanding universe of labelled bonds and maintaining a flexible, active investment strategy, the fund has outperformed its comparative benchmark. The case studies of Chile and CMPC highlight the fund’s commitment to impactful investments that align with the UN Sustainable Development Goals. As we look to the future, BlueOrchard remains dedicated to advancing best practices in impact investing, ensuring transparency, and driving meaningful change through innovative financial instruments.

The continuous efforts to refine tools and processes, adopt innovative technologies, and seek external validation demonstrate BlueOrchard’s unwavering dedication to driving positive impact and upholding industry-leading practices in impact management.

[1] Schroder International Selection Fund is referred to as Schroder ISF

[2] Source: BofA Global Research 2024

[3] Chile’s New Governance Structures Are Streamlining Net-zero Implementation: WRI, 2024

[4] CMPC Green Bond Report, 2017

[5] CMPC Sustainable Financing Framework, March 2022

[6] CMPC Sustainable Financing & Impact Report 2022 – 2023, January 2024

[7] https://www.icmagroup.org/sustainable-finance/

[8] https://bluemark.co/practice-leaderboard/

-end-

Important Information

Marketing material for Professional Clients and Qualified Investors only.

The information contained herein is confidential and may not be further distributed or reproduced by the recipient.

The information in this document was produced by BlueOrchard Finance Ltd (“BOF”), part of Schroders Capital which refers to those subsidiaries and affiliates of Schroders plc that together comprise the private markets investment division of Schroders.

This information is not an offer, solicitation or recommendation to buy or sell any financial instrument or to adopt any investment strategy.

This material must not be issued in any jurisdiction where prohibited by law and must not be used in any way that would be contrary to local law or regulation. Investors are responsible for ensuring compliance with any relevant local laws or regulations.

An investment in the Fund entails risks, which are further described in the Fund’s legal documents.

This document does not constitute an offer to anyone, or a solicitation by anyone, to subscribe for shares of Schroder International Selection Fund (the “Company”). Nothing in this document should be construed as advice and is therefore not a recommendation to buy or sell shares. An investment in the Company entails risks, which are fully described in the prospectus.

Subscriptions for shares of the Company can only be made on the basis of its latest Key Information Document and prospectus, together with the latest audited annual report (and subsequent unaudited semi-annual report, if published), copies of which can be obtained, free of charge, from Schroder Investment Management (Europe) S.A.

The Company is a Luxembourg-based Société d’Investissement à Capital Variable (SICAV) with unlimited duration which is coordinated with regard to the European regulations and meets the criteria for Undertakings for Collective Investment in Transferable Securities (UCITS).

For Austria, these documents may be obtained in German, free of charge, from the following link: www.eifs.lu/schroders and from our Information Agent Schroder Investment Management (Europe) S.A., German Branch, Taunustor 1, D-60310 Frankfurt am Main, Germany.

For Belgium, these documents may be obtained in French and Dutch, free of charge from the following link: www.eifs.lu/schroders.

The total net asset value is published on the website of the Belgian Asset Managers Association (BEAMA) on www.beama.be. In addition, the tariff schedules are available from distributors in Belgium. The fee on the stock exchange transactions of 1.32 % (with a maximum of € 4,000 per transaction) is payable on the purchase or conversion of capitalisation shares if they are carried out by the intervention of a professional intermediary in Belgium. Dividends paid by the Company to natural persons who are Belgian tax residents are subject to a Belgian withholding tax at a rate of 30% if they are paid by the intervention of a financial intermediary established in Belgium (this information applies to all distribution shares). If the dividends are received by such natural persons without the intervention of a financial intermediary established in Belgium, they must indicate the amount of the dividends received in their tax return and will be taxed on that amount at a rate of 30%. In the event of the redemption or sale of shares of a sub-fund investing, directly or indirectly, either (i) more than 25% of its assets in receivables with regard to shares acquired by the investor before January 1, 2018, or (ii) more than 10% of its assets in receivables with regard to the shares acquired by the investor from 1 January 2018 (provided, in each of these two cases, that certain additional conditions are met), the interest component of this redemption or sale price is subject to a 30% tax in Belgium.

For Bulgaria, the Key Information Documents may be obtained in Bulgarian and the other documents in English, free of charge from the following link: www.eifs.lu/schroders.

For the Czech Republic, the Key Information Documents may be obtained in Czech and the other documents in English, free of charge from the following link: www.eifs.lu/schroders.

For Denmark, the Key Information Documents may be obtained in Danish and the other documents in English, free of charge, from the following link: www.eifs.lu/schroders and Schroder Investment Management (Europe) S. A. dansk filial, Bredgade 45C, 2nd floor, DK-1260 Copenhagen K. A decision on a possible investment should be made on the basis of personal advice.

For Finland, the Key Information Documents may be obtained in Finnish, Swedish and English and the other documents in English, free of charge at the following link: www.eifs.lu/schroders.

For France, these documents may be obtained in French, free of charge, from the following link: www.eifs.lu/schroders, Schroder Investment Management (Europe) S.A., Paris Branch, 1, rue Euler, 75008 Paris and the Centralising agent Société Générale, 29 boulevard Haussmann, F-75009 Paris.

For Germany, these documents may be obtained in German, free of charge, at the following link: www.eifs.lu/schroders and Schroder Investment Management (Europe) S.A., German Branch, Taunustor 1, D-60310 Frankfurt am Main.

For Greece, the Key Information Documents may be obtained in Greek and the other documents in English, free of charge, from the following link: www.eifs.lu/schroders.

For Hungary, the Key Information Documents may be obtained in Hungarian and the other documents in English, free of charge, from the following link: www.eifs.lu/schroders.

For Iceland, the Key Information Documents may be obtained in Icelandic and the other documents in English, free of charge, from the following link: www.eifs.lu/schroders.

For Ireland, these documents may be obtained in English, free of charge, from the following link: www.eifs.lu/schroders.

For Italy, these documents may be obtained in Italian, free of charge, from the following link: www.eifs.lu/schroders, Schroder Investment Management (Europe) S.A. Succursale Italiana, Via Manzoni 5, 20121 Milan and from our distributors. These documents and the list of distributors are available at www.schroders.it

For Latvia, the Key Information Documents may be obtained in Latvian and the other documents in English, free of charge, from the following link: www.eifs.lu/schroders.

For Liechtenstein, these documents may be obtained in German, free of charge, from the following link: www.eifs.lu/schroders.

For Lithuania, the Key Information Documents may be obtained in Lithuanian and the other documents in English, free of charge, from the following link: www.eifs.lu/schroders.

For Luxembourg, these documents may be obtained in English, free of charge, from the following link: www.eifs.lu/schroders.

For Malta, these documents may be obtained in English, free of charge, from the following link: www.eifs.lu/schroders.

For the Netherlands, the Key Information Documents may be obtained in Dutch and the other documents in English, free of charge, from the following link: www.eifs.lu/schroders.

For Norway, the Key Information Documents may be obtained in Norwegian and English and the other documents in English, free of charge, from the following link: www.eifs.lu/schroders.

For Poland, the Key Information Documents may be obtained in Polish and the other documents in English, free of charge, from the following link: www.eifs.lu/schroders.

The company is a Luxembourg-registered undertaking for the collective investment in transferable securities and operates in Poland in accordance with the Act of 27 May 2004 on investment funds and the management of alternative investment funds (Journal of Laws of 2004 No. 146, item 1546 as amended). Depending on the applicable tax obligations, the investor may be required to pay tax directly on the income arising from investments in the units of the fund.

For Spain, these documents may be obtained in Spanish, free of charge, from the following link: www.eifs.lu/schroders, the CNMV, the distributors and on www.schroders.es.

The Company is registered in the Administrative Register of Foreign Collective Investment Institutions marketed in Spain of the National Securities Market Commission (CNMV), with the number 135. Its depository is J.P. Morgan SE and its management company is Schroder Investment Management (Europe) S.A.. The Company is a UCITS registered in Luxembourg.

For Sweden, the Key Information Documents may be obtained in Swedish and the other documents in English, free of charge, from the following link: www.eifs.lu/schroders.

Schroder Investment Management (Switzerland) AG is the Swiss representative (“Swiss Representative”) and Schroder & Co Bank AG is the paying agent in Switzerland of the Luxembourg domiciled Schroder International Selection Fund. The prospectus for Switzerland, the key information documents, the articles of association and the annual and semi-annual reports may be obtained free of charge from the Swiss Representative.

For the UK, these documents may be obtained in English, free of charge, from the following link: www.eifs.lu/schroders.

The Fund has the objective of sustainable investment within the meaning of Article 9 of Regulation (EU) 2019/2088 on Sustainability-related Disclosures in the Financial Services Sector (the “SFDR”). For information on sustainability-related aspects of this fund please go to www.schroders.com

Any reference to regions/countries/sectors/stocks/securities is for illustrative purposes.

Past performance is not a guide to future performance and may not be repeated.

The value of investments and the income from them may go down as well as up and investors may not get back the amounts originally invested. Exchange rate changes may cause the value of any overseas investments to rise or fall.

Performance data does not take into account any commissions and costs, if any, charged when units or shares of any fund, as applicable, are issued and redeemed.

Schroders Capital has expressed its own views and opinions in this document and these may change without notice.

Information herein is believed to be reliable but Schroders Capital does not warrant its completeness or accuracy.

The use of UN Sustainable Development Goals (SDG) icons or logo, including the colour wheel, is for purely informational purposes. The use of SDG icons and/or any reference to the SDGs is non-promotional and in no way is intended to imply any affiliation with or endorsement by the United Nations.

The data contained in this document has been sourced by Schroders Capital and should be independently verified. Third party data is owned or licenced by the data provider and may not be reproduced, extracted or used for any other purpose without the data provider’s consent. Neither Schroders Capital, nor the data provider, will have any liability in connection with the third-party data.

The terms of the third party’s specific disclaimers, if any, are set forth in the Important Information section at www.schroders.com.

This document may contain “forward-looking” information, such as forecasts or projections. Please note that any such information is not a guarantee of any future performance and there is no assurance that any forecast or projection will be realised.

BOF has outsourced the provision of IT services (operation of data centres, data storage, etc.) to Schroders group companies in Switzerland and abroad. A sub-delegation to third parties including cloud-computing service providers is possible. The regulatory bodies and the audit company took notice of the outsourcing and the data protection and regulatory requirements are observed.

For information on how Schroders Capital may process your personal data, please view our Privacy Policy available at https://www.schroders.com/en/global/individual/footer/privacy-statement/ or on request should you not have access to this webpage.

Issued by Schroder Investment Management (Europe) S.A., 5, rue Höhenhof, L-1736 Senningerberg, Luxembourg. Registration No B 37.799.

Distributed by Schroder Investment Management (Europe) S.A., Spanish branch, registered in the EEA investment firm register with the National Market Commission of Securities (CNMV) with the number 20.

Distributed in Switzerland by Schroder Investment Management (Switzerland) AG, Central 2, CH-8001 Zurich, Switzerland a fund management company authorised and supervised by the Swiss Financial Market Supervisory Authority FINMA, Laupenstrasse 27, CH-3003 Bern.

Distributed in the UK by Schroder Investment Management Ltd, 1 London Wall Place, London EC2Y 5AU. Registration No 1893220 England. Authorised and regulated by the Financial Conduct Authority.

For more information, visit www.blueorchard.com, www.schroderscapital.com or www.schroders.com