Financial inclusion has emerged as a critical means to improve access to essential services in many emerging market economies. [1] By granting individuals access to financial services like savings accounts, credit facilities, and insurance, financial inclusion empowers them to make informed financial decisions and invest in essential services such as education.

Given the significant education finance gap in low- and lower-middle-income countries [2], households play a significant role in education financing, with figures varying across countries and regions. For instance, in Sub-Saharan Africa, households account for 30% of total education spending compared to 15% in high-income countries. [3]

While these expenses partially result from an increasing preference for (low-cost) private education, even “free” public education results in costs for families. [4] However, many lower-income households struggle to afford education-related expenses, such as school fees, textbooks, and uniforms, in particular because many households in African countries have unpredictable and irregular incomes, making it difficult to pay for large one-time costs. [5]

Access to responsible financial services can enable households to shoulder these expenses and spread the costs of education over the school term, increasing families’ ability to send their children to school. For example, one study in Uganda showed that among households who received a digital education loan, the share of children out of school declined by 50%. [6]

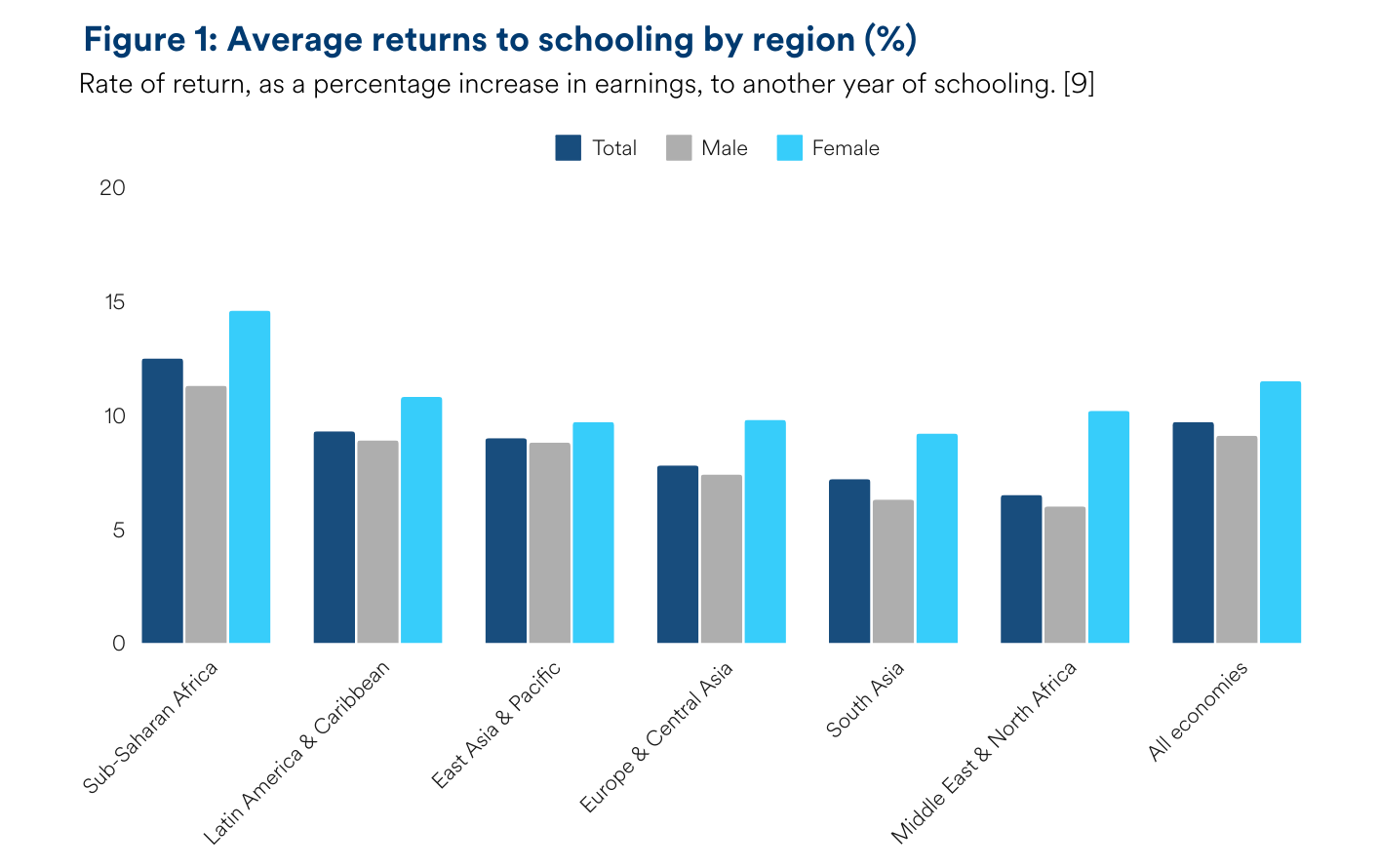

Education is often regarded as one of the best investments individuals can make for themselves or their families. [7] Each additional year of schooling has been shown to increase income by an average of 9.7% globally. This effect is even stronger in Sub-Saharan Africa, where the associated average income increase is 12.5%.

Notably, women in Sub-Saharan Africa experience the highest return on education in the world, with a staggering average income increase for each additional year of schooling of 14.6%. [8] Naturally, these returns on education are typically experienced in the long run. Education equips individuals with the necessary skills and knowledge to access better employment opportunities, leading to increased income potential in the future.

In the financial inclusion sector, a distinction is often made between productive or income-generating loans, typically provided to microentrepreneurs or SMEs, and consumption loans, which are used to pay for other household expenses that do not immediately result in increased income that allows borrowers to pay back the loan. [10] However, under the umbrella term of “consumption”, households tend to spend on essential services that have a significant impact on their quality of life, such as education, healthcare or housing improvements. Access to financial services enables consumption smoothing – the ability to maintain a steady standard of life and pay for essential services even in the face of unsteady income and expenses – which is a key enabler of financial health and resilience. [11] Borrowing for education is thus not an investment in an “income-generating” activity as per the definition of financial institutions and may not immediately serve to pay back the loan, but in terms of impact on borrowers’ lives, it could very well be considered an investment in their future income, blurring the lines of what “consumption” and “productive” loans stand for.

Financial institutions can play a crucial role in fostering investments in education by offering dedicated education finance products. These loan products cater to the specific needs of students, parents, and educational institutions, ensuring effective financing of education-related expenses. However, access to responsible financial services for consumer lending can contribute to these goals more broadly. Households can utilise such products to pay not only for education but also for other essential services like healthcare or housing improvements, all of which enhance their quality of life in the short- and long term. To ensure the effectiveness of these loans, it is essential to implement solid client protection measures and prevent customers from becoming overindebted. Financial inclusion can empower individuals to invest in their education, enhancing their income potential, and contributing to economic development, ultimately acting as a catalyst for positive change particularly in emerging markets.

Important Information

Marketing material for Professional Clients and Qualified Investors. The information contained herein is confidential and may not be further distributed or reproduced by the recipient The information in this document was produced by BlueOrchard Finance Ltd (“BOF”), a member of the Schroders Group.

Past performance is not a guide to future performance and may not be repeated. The value of investments and the income from them may go down as well as up and investors may not get back the amounts originally invested. Exchange rate changes may cause the value of any overseas investments to rise or fall. Performance data does not take into account any commissions and costs, if any, charged when units or shares of any fund, as applicable, are issued and redeemed.

Emerging markets impact investments involve a unique and substantial level of risk that is critical to understand before engaging in any prospective relationship with BOF and its various managed funds. Investments in emerging markets, particularly those involving foreign currencies, may present significant additional risk and in all cases the risks implicated in this disclaimer include the risk of loss of invested capital.

BOF has expressed its own views and opinions in this document and these may change without notice. Information herein is believed to be reliable but BOF does not warrant its completeness or accuracy.

The data contained in this document has been sourced by BOF and should be independently verified. Third party data is owned or licenced by the data provider and may not be reproduced, extracted, or used for any other purpose without the data provider’s consent. Neither BOF nor the data provider will have any liability in connection with the third party data. The terms of the third party’s specific disclaimers, if any, are set forth in the Important Information section at www.blueorchard.com/legal-documents/.

This document may contain “forward-looking” information, such as forecasts or projections. Please note that any such information is not a guarantee of any future performance and there is no assurance that any forecast or projection will be realised.

BOF has outsourced the provision of IT services (operation of data centres, data storage, etc.) to Schroders group companies in Switzerland and abroad. A sub-delegation to third parties including cloud-computing service providers is possible. The regulatory bodies and the audit company took notice of the outsourcing and the data protection and regulatory requirements are observed. For information on how BOF and the Schroders Group may process your personal data, please view the BOF Privacy Policy available at www.blueorchard.com/legal-documents/ and the Schroders’ Privacy Policy at https://www.schroders.com/en/global/individual/footer/privacy-statement/ or on request should you not have access to these webpages.

Issued by BlueOrchard Finance Ltd, Talstrasse 11, CH-8001 Zurich, a manager of collective investment schemes authorised and supervised by the Swiss Financial Market Supervisory Authority FINMA, Laupenstrasse 27, CH-3003 Bern.

Copyright © 2025, BlueOrchard Finance Ltd. All rights reserved.

Sources:

[1] Mattern, M. (2022). Essential Role of Finance in Education, Housing, and Health Care. Retrieved from link.

[2] It is estimated that between 2023 and 2030, there will be an average annual financing gap of USD 97 billion per year for low- and lower-middle-income countries to achieve their national targets for Sustainable Development Goal 4 (‘Quality Education’). Source: UNESCO. (2023). Global Education Monitoring Report, 2023: Technology in Education: A Tool on Whose Terms? Retrieved from link.

[3] World Bank & UNESCO. (2022). Education Finance Watch 2022. Retrieved from link.

[4] World Bank & UNESCO. (2023). Education Finance Watch 2023. Retrieved from link.

[5] Mattern, M. (2022). Essential Role of Finance in Education, Housing, and Health Care. Retrieved from link.

[6] Mattern, M. & Garcia, A. (2021.). In Uganda, Solar Home Systems Help Students Stay in School. Retrieved from link.

[7] Vahey, S. P. (2018). Estimating Return to Schooling using the Mincer Equation. IZA World of Labor. Retrieved from link.

[8] Montenegro, C. E. & Patrinos, H. A. (2014). Comparable Estimates of Returns to Schooling around the World. World Bank Policy Research Working Paper No.7020. Retrieved from link.

[9] Montenegro, C. E. & Patrinos, H. A. (2014). Comparable Estimates of Returns to Schooling around the World. World Bank Policy Research Working Paper No.7020. Retrieved from link.

[10] Pories, L. (2019). The Productive Versus Consumption Loans Distinction Hurts Rather Than Helps. FinDev Gateway. Retrieved from link.

[11] Rhyne, E. (2018). Financial Services Through the Eyes of Customers. Center for Financial Inclusion. Retrieved from link.