The nature of the economic landing will have direct implications not only for default rates but also for the valuation of all asset classes, as it will be influenced by discount factors. Additionally, 2024 is poised to be a year marked by political risks, driven by a series of sensitive elections and ongoing military conflicts across the globe.

In this outlook, we will dive into various factors that impact EM hard currency bonds, including fundamentals, technical indicators, and valuations. These factors are expected to exert a direct influence on the returns of EM fixed income investments.

By examining these key aspects, we aim to provide an overview of the opportunities and challenges that lie ahead in the EM Fixed Income space for the year 2024.

Market participants may witness fewer rate cuts than initially anticipated

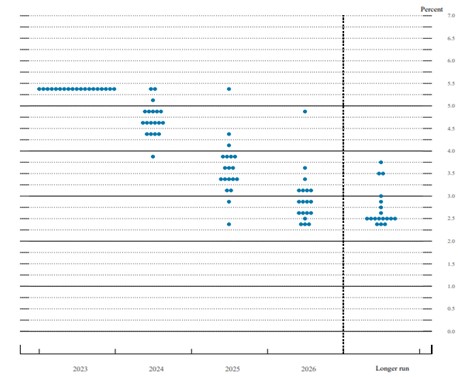

The market is currently pricing in a soft landing with six rate cuts expected in 2024, while the Federal Reserve’s (Fed) projections indicate only three cuts We anticipate that the market may be disappointed, but it remains unclear whether this disappointment will be due to a hard landing or concerns about the pace of rate cuts.

Figure 1: FOMC participants’ assessments of appropriate monetary policy: Midpoint of target range or target level for the federal funds rate. Adapted from US Federal Reserve, Summary of Economic Projections, 2023.

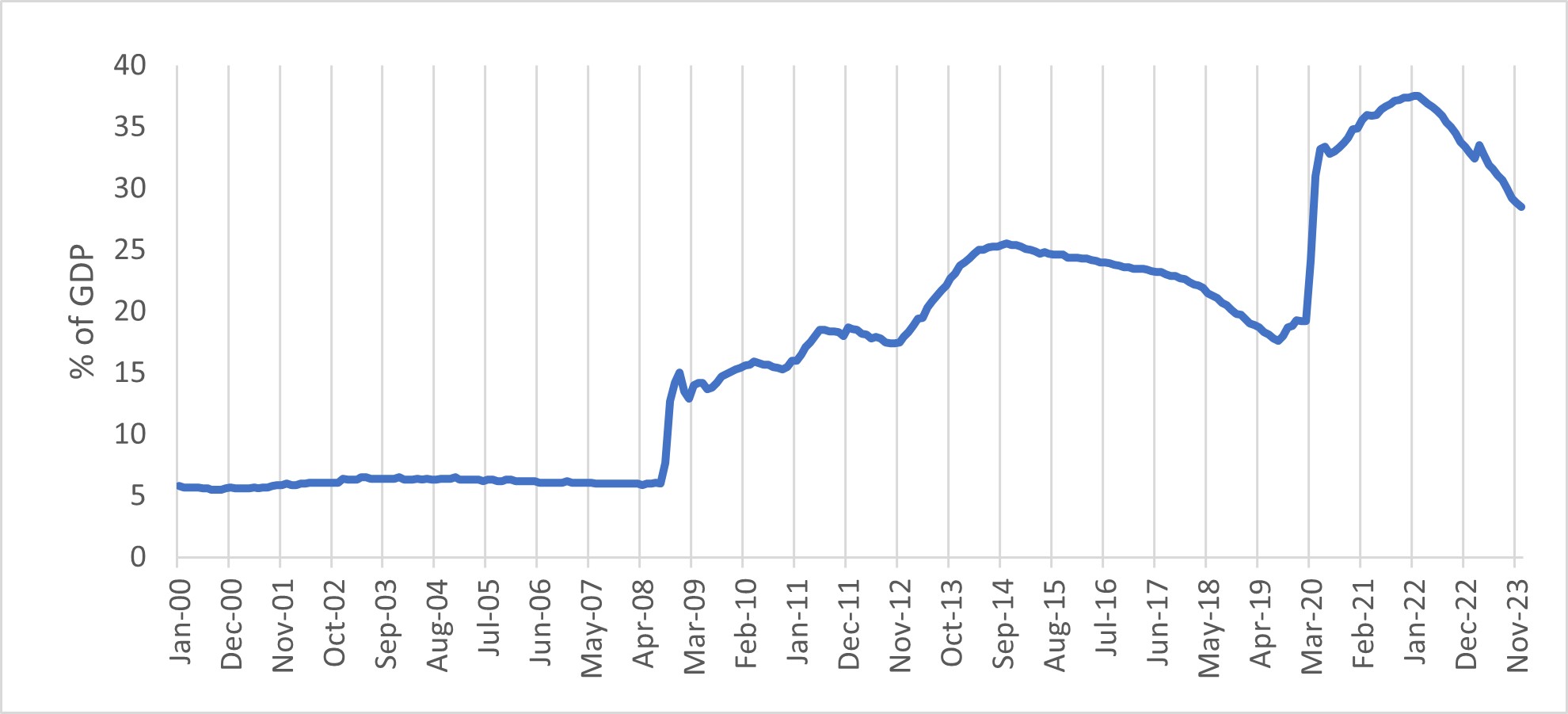

In the absence of a recession or a significantly weak labour market, it is unlikely that we will see inflation drop below 2.5% or that the Fed will be implementing such a high number of rate cuts. While a reduction of 50-75 basis points could be justified to move towards a more neutral policy stance, the Fed will likely want to preserve some ammunition in case of a future recession and will also need to normalise its balance sheet (see Figure 2). Therefore, market participants may witness fewer rate cuts than initially anticipated.

Figure 2: Federal reserve balance sheet from 2000 to 2023. Sources: Bloomberg; US Federal Reserve, 2023

Considering that the effect of the monetary policy on the economy operates with a lag, there is a risk that economic growth could decelerate more than anticipated, potentially leading to a recession. In this scenario, investors may become concerned about debt sustainability, as both corporates and governments have become accustomed to a low-rate environment and may struggle to cope with higher refinancing rates. This could result in not only six or more rate cuts, but also higher spreads driven by increased default risk.

While the trajectory of interest rates remains uncertain and will depend on where inflation ultimately stabilises, we believe that the US dollar rate curve will steepen. If a recession is avoided and inflation stabilises at a higher level, we expect to begin normalising its balance sheet, which would lead to higher long-term rates. However, if a recession does occur, we may see even further rate cuts, mostly impacting the shorter end of the yield curve, while the longer end is kept elevated due to increased issuance and concerns about debt sustainability.

Markets have demonstrated a greater ability to adapt to the new monetary policy regime

It is noteworthy that despite the rapid and substantial hiking cycle, market liquidity remains robust. This is evident from our liquidity indicators, which measure funding stress in the global financial system, including swap-spreads that gauge liquidity risk. Neither of these indicators signal any significant concerns or stress.

One possible explanation for this phenomenon is that the markets have demonstrated a greater ability to adapt to the new monetary policy regime than initially anticipated. By already pricing in rate cuts for 2024, the market has effectively mitigated a portion of the impact from the Federal Reserve’s rate hikes.

If this is indeed the case, it raises questions about the effectiveness of monetary policy in addressing cyclical inflation. There appears to be a disconnect between the expected slowdown in inflation driven by monetary policy and the absence of funding stress. Monitoring liquidity levels could prove to be a valuable indicator in assessing whether inflation is likely to stabilise at higher levels or if a recession is looming on the horizon.

Emerging markets positioned for growth

We anticipate that EM countries will outperform developed market (DM) countries in terms of growth. This is primarily due to the greater flexibility that EM countries have in terms of both monetary and fiscal support.

One key distinction between EM and DM countries lies in the composition of their consumer price inflation baskets, particularly the importance of food prices. While DM inflation slowdown may be constrained by elevated wage growth and a tight labour market, the decrease in inflation resulting from lower food prices in EM countries appears to be more sustainable. This provides EM central banks with greater leeway to ease monetary policy if necessary.

On the fiscal side, EM countries have traditionally managed debt sustainability concerns better than their DM counterparts. According to the International Monetary Fund’s World Economic Outlook Database from October 2023, the gross debt of G7 countries is projected to reach 128% of GDP by the end of 2023, while it is expected to be around 67% for EM and developing economies. Although there is considerable variation within these numbers, on average, EM countries have more room for their governments to support their economies. For instance, China is expected to implement a significant fiscal deficit to bolster its economy and combat deflation, which is likely to have a global impact within the region.

Overall, the combination of greater monetary policy flexibility and relatively healthier fiscal positions EM countries favourably for potential growth compared to DM countries.

Focus on high-quality issuers

While credit spreads may appear tight from a historical perspective, the attractiveness of the bond yields cannot be overlooked, particularly given their reduced exposure to economic cycles. The yield of EM corporate bonds of around 7% (as of 2 January 2024) compares well to the long-term average return of equities, which varies between 6.5-7%[1].

The breakeven level is particularly appealing. With a duration of approximately 4.30, the CEMBI yield would need to widen by more than 160 basis points (bps) in 2024 for the mark-to-market performance to offset the carry. Even if the Fed disappoints and cuts rates by only 75 bps instead of 150 bps, this will result in a 75-bps widening on the shorter end, which would still be within the breakeven range.

In the event of a recession, we may see spreads widen by more than 160 bps, but the risk-free rate would move in the opposite direction. By focusing on high-quality issuers, we can increase our exposure to the risk-free rate and optimise our expected risk-adjusted return in our main scenarios.

More local currency issuances expected

On the supply side, the market is expected to see stable gross issuance in 2024, following the low levels seen in 2023. The negative net financing and limited availability of bonds should support market prices, as benchmark investors will need to reinvest coupon payments and maturing bonds to avoid becoming underweight.

Unlike in 2022 and 2023, where the lack of issuance was driven by challenging market conditions, we anticipate that companies will issue more in local currency this year. With the rise in USD rates, there is less incentive for companies to raise debt on the international market, and they are likely to prefer their local options.

Bottom-up selection remains critical

We anticipate significant dispersion in 2024, which will create opportunities for active portfolio managers to generate alpha. We believe that issuers with excessive leverage will likely underperform due to the increased cost of funding. As higher rate starts to bite, companies that have relied on cheap funding to enhance profitability may face challenges in the coming year.

Given the multiple elections and conflicts happening around the world, we expect the market to incorporate a considerable amount of political risk. Unlike the leverage cycle, political risk premiums are mostly idiosyncratic in nature and can be diversified. While they need to be assessed on a case-by-case basis, they can provide attractive entry points as non-specialists exit the market.

Considering our expectation for the interest curve to steepen, along with the risk of a recession, we favor investment-grade securities and the shorter end of the yield curve. These segments still offer attractive carry characteristics. With strong expectations for a soft landing, there is room for disappointment, and we see no need to take unnecessary risks.

Conclusion: Hard or soft landing?

This year, the focus of the beta market call will be on determining the type of landing we can expect. Will it be a hard landing, leading to a recession, higher spreads, and significant cuts from the Fed? Or will it be a soft landing? In this scenario, where will US inflation stabilise, and what will be the consequences for the Fed?

To assess the probabilities between these two scenarios, we will closely monitor financial market liquidity, which serves as a good indicator of the impact of monetary policy tightening on the real economy.

Additionally, we anticipate that EM hard currency bonds will outperform other asset classes this year. We believe that these bonds will be supported by strong technical factors as well as robust fundamentals.

Lastly, we expect that while the past two years have been primarily driven by beta, the majority of financial outperformance will come from relative value trades. Geopolitical risks, as well as the distinction between winners and losers in this new market environment, should generate the dispersion required for active portfolio managers to outperform.

[1] Jeremy J. Siegel, Stocks for the Long Run: The Definitive Guide to Financial Market Returns & Long-Term Investment Strategies, fifth edition, New York, NY: McGraw-Hill Education, 2014.

-end-

Important Information

This document was produced by BlueOrchard Finance Ltd (“BOF”) to the best of its present knowledge and belief. Information herein is believed to be reliable, but BOF does not warrant its completeness or accuracy. BOF has expressed its own views and opinions in this document, and these may change. They do not necessarily reflect the opinion of Schroders Group.

BOF is part of Schroders Capital, the private markets investment division of Schroders Group.

This information is a marketing communication and is not to be seen as investment research. As such it is not prepared pursuant legal requirements established for the promotion of independent investment research nor subject to any prohibition on dealing ahead of the distribution of investment research.

The information in this document is the sole property of BOF unless otherwise noted and may not be reproduced in full or in part without the express prior written consent of BOF.

Any reference to sectors/countries/stocks/securities are for illustrative purposes only and not a recommendation to buy or sell any financial instrument/securities or adopt any investment strategy.

All investments involve risks. Past performance is not a guide to future performance and may not be repeated. The value of investments and the income from them may go down as well as up and investors may not get back the amounts originally invested. Exchange rate changes may cause the value of investments to fall as well as rise. Performance data does not take into account any commissions and costs, if any, charged when units or shares of the fund are issued and redeemed.

Emerging markets impact investments involve a unique and substantial level of risk that is critical to understand before engaging in any prospective relationship with BOF and its various managed funds. Investments in emerging markets, particularly those involving foreign currencies, may present significant additional risk and in all cases the risks implicated in this disclaimer include the risk of loss of invested capital. To understand specific risks of an investment, please refer to the currently valid legal investment documentation.

This document may contain “forward-looking” information, such as forecasts or projections. Please note that any such information is not a guarantee of any future performance and there is no assurance that any forecast or projection will be realised. Scenarios presented are an estimate of future performance based on evidence from the past on how the value of this investment varies, and/or current market conditions and are not an exact indicator. BOF does not in any way ascertain that the statements concerning future developments will be correct. Unless this fund contains a capital guarantee, what you will get will vary depending on how the market performs and how long you keep the investment/product. Performance is subject to your individual taxation circumstances which may change in the future.

This document does not constitute an offer to anyone, or a solicitation by anyone, to subscribe for shares of a fund managed or advised by BOF. Nothing in this document should be construed as advice and is therefore not a recommendation to buy or sell shares. An investment in a fund entails risks, which are fully described in the fund’s legal documents.

We note in particular that none of the investment products referred to in this document constitute securities registered under the Securities Act of 1933 (of the United States of America) and BOF and its managed/advised funds are materially limited in their capacity to sell any financial products of any kind in the United States. No investment product referenced in this document may be publicly offered for sale in the United States and nothing in this document shall be construed under any circumstances as a solicitation of a US Person (as defined in applicable law/regulation) to purchase any BOF investment product.

The material is not intended to provide, and should not be relied on for, accounting, legal or tax advice, or investment recommendations.

By no means is the information provided in this document aimed at persons who are residents of any country where the product mentioned herein is not registered or approved for sale or marketing or in which dissemination of such information is not permitted. Persons who are not qualified to obtain such document are kindly requested to discard it or return it to the sender.

No Schroders entity nor BOF accept any liability for any error or omission in this material or for any resulting loss or damage (whether direct, indirect, consequential or otherwise), in each case save to the extent such liability cannot be excluded under applicable laws.

The BlueOrchard managed funds have the objective of sustainable investment within the meaning of Article 9 Regulation (EU) 2019/2088 on Sustainability related Disclosure in the Financial Services Sector (the SFDR). For information on sustainability related aspects of this fund please go to https://www.blueorchard.com/sustainability-disclosure-documents/ .

The fund’s prospectus, key investor information if any and annual reports are available free of charge upon request at BlueOrchard Asset Management (Luxembourg) S.A., 1 rue Goethe, L-1637 Luxembourg. The prospectus and the Key Investor Information for Switzerland, if any, the articles, the interim and annual reports, the list of purchases and sales and other information can be obtained free of charge from the representative in Switzerland: 1741 Fund Solutions AG, Burggraben 16, 9000 St. Gallen. The paying agent in Switzerland is Bank Tellco AG, Bahnhofstrasse 4, 6430 Schwyz.

BOF may decide to cease the distribution of any fund(s) in any EEA country at any time but we will publish our intention to do so on our website, in line with applicable regulatory requirements.

Third party data is owned or licensed by the data provider and may not be reproduced or extracted and used for any other purpose without the data provider’s consent. Third party data is provided without any warranties of any kind. The data provider and issuer of the document shall have no liability in connection with the third-party data. The Prospectus contains additional disclaimers which apply to the third-party data.

Source: MSCI

MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indexes or any securities or financial products. This report is not approved, endorsed, reviewed or produced by MSCI. None of the MSCI data is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such.

BOF has outsourced the provision of IT services (operation of data centers, data storage, etc.) to Schroders group companies in Switzerland and abroad. A sub-delegation to third parties including cloud-computing service providers is possible. The regulatory bodies and the audit company took notice of the outsourcing and the data protection and regulatory requirements are observed.

A summary of investor rights may be obtained from https://www.blueorchard.com/imprint/

Copyright © 2024, BlueOrchard Finance Ltd. All rights reserved.