The microfinance asset class is uniquely positioned at the crossroads of significant global economic changes. It is harnessing technological advancements and adapting to continuously evolving financial needs, particularly in developing countries. By providing loans to micro, small, and medium-sized enterprises (MSMEs), private credit remains a vital strategy for promoting financial inclusion, especially for those who face barriers to accessing traditional banking services.

Economic development in emerging markets is a dynamic landscape influenced by factors including economic policies, geopolitical shifts, regulatory changes, and monetary strategies. This interplay of forces presents both hurdles and opportunities for the microfinance sector. By remaining agile and responsive to these evolving conditions, microfinance can strengthen its role in supporting MSMEs. This adaptability will be key to driving sustainable economic growth and fostering resilience in communities often on the front lines of change.

These shifts are set to drive significant growth in the global microfinance market, projected to reach around USD 331 billion by 2029, with an annual growth rate in excess of 10%[1]. Financial inclusion remains a critical priority on the global development agenda, and the funding needs of the MSME sector in developing economies are substantial, estimated at USD 5.2 trillion, with some estimates suggesting that the total financing gap could be as high as USD 8 to 9 trillion when including informal enterprises[2]. This financing gap presents both a pressing need and a unique opportunity for increased investment in the asset class.

Changing interest rate environment

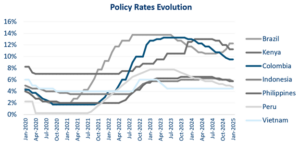

While most markets have started to adjust benchmark interest rates to reduce inflation and movements in USD rates and currency, the picture is far from unified. We have observed reductions in local policy rates in countries like Kenya, Peru, and Colombia, but have seen contrary developments, for example, in Brazil, where rates started to increase again in the context of persistent inflation, or remained stable, as in Indonesia and Vietnam (see chart below).

Source: LSEG Refinitiv, as of January 20th, 2025.

These differences in interest rate policies can lead to disparities in capital costs for microfinance institutions (MFIs) across different countries and regions.

Throughout the last cycle, we observed how higher funding costs have pressured net interest margins, especially in jurisdiction where regulators have imposed either explicit or de facto caps on interest rates. For 2025, we expect increasing demand in countries with reducing rate developments. In parallel, the operational adjustments many MFIs have put in place to increase efficiency will continue to play out, increasing attractiveness even further.

Continuous growth and favourable demographics

Emerging markets are set to significantly drive global population and income growth, with India projected to become the world’s third-largest economy in 2027[3], and Africa’s population expected to almost double by 2050[4]. This demographic expansion will increase consumer demand and push entrepreneurship, particularly in regions like Africa and Asia, with the International Monetary Fund (IMF) projecting that Africa will host twelve of the world’s 20 fastest-growing economies in 2025 despite challenges from conflict and lacking infrastructure. As more individuals enter the workforce in developing countries, demand increases for financial services tailored to support new businesses and innovations. The rapid expansion of the working-age population presents substantial opportunities for MSMEs as they contribute significantly to job creation across these economies.

In South Asia, robust domestic demand driven by tourism recovery is expected to support economic growth. Countries such as Indonesia and Philippines are likely to benefit from government infrastructure investments aimed at attracting foreign direct investment (FDI), further enhancing economic prospects. Local policies promoting access to finance for MSMEs, such as for example in Indonesia and Vietnam, are supportive factors.

In Latin America, moderate growth of the MSME sector is anticipated as economies recover from previous slowdowns. However, the reshoring trend directed by Western companies is expected to further support businesses, including MSMEs, which already contribute to over 60% of employment opportunities globally[5]. Furthermore, private sector credit in Latin America, as a percentage of GDP, has increased to 50-60% but remains well below US or European levels[6]. This disparity indicates a significant need and opportunity in private sector lending as the MSME sector develops.

Digitalisation and sustainable energy

Rapid technological advancements and digitalisation are also transforming how microfinance services are delivered. An increasingly tech savvy young population is driving the adoption of new technologies in low-and-middle-income markets. Many of those same markets are making significant progress with strong ICT infrastructure, as illustrated by regions such as Latin America or parts of Europe and Central Asia who have achieved around 80% internet penetration[7] in recent years. Mobile banking and digital wallets are revolutionising financial services by providing greater access and alternative solutions to traditional banking limitations, enhancing operational efficiency while expanding market reach for MFIs in regions with strong economic prospects like East Africa, where growth rates of around 5.7% are projected for 2025-26[8]. All progress aside, the digital infrastructure in many African countries still needs substantial investments, presenting an opportunity for investors with strong local knowledge. In Asia, countries such as Vietnam are experiencing a surge in digital lending platforms that enhance credit access for underserved populations. Indonesia’s fintech sector is one of the most dynamic in Southeast Asia, being home to 20% of ASEAN fintech companies and expected to generate USD 8.6 billion worth of revenue by 2025[9]. The number of players in the sector has grown sixfold since 2011[10]. These platforms allow for easier interaction with consumers and more personalised financial products tailored to the unique needs of micro-entrepreneurs.

Concurrently, the shift towards sustainable energy solutions is also accelerating, driven by technological advancements that reduce costs for renewable energy sources like solar power and e-vehicles. In Africa and Asia, MFIs are playing a crucial role in financing green initiatives, such as, for example, affordable rooftop solar panels for households and small businesses or e-vehicles for transportation. The sector has seen significant developments; in countries such as Ghana, where we witnessed the build-out of a large rooftop solar initiative, with close to 30,000 solar panels installed with the capacity to power up to 50,000 homes[11]. In similar cases, MFIs can facilitate access to funding that supports sustainable energy solutions and promotes job creation within local communities.

Positive outlook for 2025

Looking ahead, the anticipated expansion in internet penetration and digitalisation is set to significantly enhance the outreach of the MSME lending market, paving the way for greater financial inclusivity. With demographics shifting and digital access on the rise, the evolution of this sector offers promising opportunities for financial access that promotes equality and economic growth, especially in underserved communities where micro-entrepreneurs and small businesses can thrive. Greater connectivity, access to sustainable energy, and evolving MSME lending strategies indicate significant investment potential while allowing flexible capital allocation to regions with promising growth prospects, thus further shaping the microfinance landscape in developing economies.

Overall, as MFIs adapt to the current economic environment and leverage technological advancements, strong institutions will be well-positioned to support MSMEs and drive sustainable economic growth. Investors who strategically allocate resources into this asset class can expect not only significant contributions to underserved communities but aim to achieve resilient and geographically diversified financial returns.

-end-

Important Information

Marketing material for Professional Clients and Qualified Investors. The information contained herein is confidential and may not be further distributed or reproduced by the recipient The information in this document was produced by BlueOrchard Finance Ltd (“BOF”), a member of the Schroders Group.

Past performance is not a guide to future performance and may not be repeated. The value of investments and the income from them may go down as well as up and investors may not get back the amounts originally invested. Exchange rate changes may cause the value of any overseas investments to rise or fall. Performance data does not take into account any commissions and costs, if any, charged when units or shares of any fund, as applicable, are issued and redeemed.

Emerging markets impact investments involve a unique and substantial level of risk that is critical to understand before engaging in any prospective relationship with BOF and its various managed funds. Investments in emerging markets, particularly those involving foreign currencies, may present significant additional risk and in all cases the risks implicated in this disclaimer include the risk of loss of invested capital.

BOF has expressed its own views and opinions in this document and these may change without notice. Information herein is believed to be reliable but BOF does not warrant its completeness or accuracy.

The data contained in this document has been sourced by BOF and should be independently verified. Third party data is owned or licenced by the data provider and may not be reproduced, extracted, or used for any other purpose without the data provider’s consent. Neither BOF nor the data provider will have any liability in connection with the third party data. The terms of the third party’s specific disclaimers, if any, are set forth in the Important Information section at www.blueorchard.com/legal-documents/.

This document may contain “forward-looking” information, such as forecasts or projections. Please note that any such information is not a guarantee of any future performance and there is no assurance that any forecast or projection will be realised.

BOF has outsourced the provision of IT services (operation of data centres, data storage, etc.) to Schroders group companies in Switzerland and abroad. A sub-delegation to third parties including cloud-computing service providers is possible. The regulatory bodies and the audit company took notice of the outsourcing and the data protection and regulatory requirements are observed. For information on how BOF and the Schroders Group may process your personal data, please view the BOF Privacy Policy available at www.blueorchard.com/legal-documents/ and the Schroders’ Privacy Policy at https://www.schroders.com/en/global/individual/footer/privacy-statement/ or on request should you not have access to these webpages.

Issued by BlueOrchard Finance Ltd, Talstrasse 11, CH-8001 Zurich, a manager of collective investment schemes authorised and supervised by the Swiss Financial Market Supervisory Authority FINMA, Laupenstrasse 27, CH-3003 Bern.

Copyright © 2025, BlueOrchard Finance Ltd. All rights reserved.

Sources:

[1] Microfinance Market Report (2024)

[2] MSME Finance Gap, World Bank (2017)

[3] EY, Srivastava D. K. (2023)

[5] United Nations, MSMEs (June 2024)

[7] WorldBank, Global Digitalization (2023)

[8] WorldBank, The World Bank in Africa (2024)

[9] International Trade Administration, Financial Technology (2024)

[10] BCG, The Rise of Fintech in Indonesia (2023)

[11] LMI Holdings (2024)