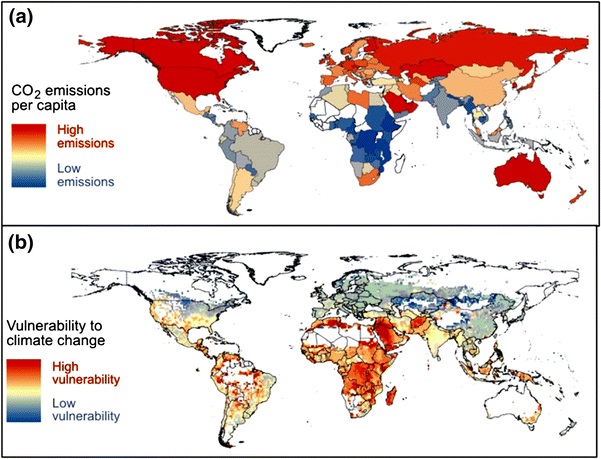

Countries considered emerging and frontier markets have historically been amongst the smallest contributors to climate change, but remain among the most vulnerable to its effects. The impact of climate change on these poorer nations is amplified by a dependence on agriculture as an economic driver and a higher share of people with no access to insurance. There is little that people in these countries can do to mitigate the threat of climate change on their livelihoods, as the threats come from elsewhere. However, they can take measures to adapt, and those adaptations will be essential to the survival of the agricultural sector in many countries around the world. We are confronting the question of whether climate insurance should be available for a select few, or should it be tailored and affordable to those vulnerable populations who need it most? In our view, the answer is simple. More people in more places need access to reliable, affordable climate risk insurance.

Figure 1: Vulnerability to climate change and CO2 contribution by geographical location

(source: Saraswat & Kumar, 2016 via BlueOrchard Academy Rethinking Climate Finance)

When it comes to climate finance, only five percent of investments have focused on the theme of adaptation with the vast majority allocated to mitigation activities such as reducing greenhouse gas emissions or investing in renewable energy. This disparity has resulted in a considerable investment gap in climate adaptation, which is estimated to be somewhere in the region of £180-280 billion per year.

Investment in climate adaptation spans a wide range of potential sectors –from developing technologies and data that provide early warning of extreme weather events to facilitating more readily available insurance (e.g. crop and animal husbandry insurance) products to defend economically against the effects of climate change.

Tackling these market gaps has been of particular interest to BlueOrchard as manager of the InsuResilience Investment Fund (IIF). Insurance providers and insurance-related initiatives can play a critical role in mitigating the financial impacts of adverse climate events on poor and vulnerable populations. Insurance pay-outs reach people much faster than emergency relief and can also encourage people to implement effective adaptation strategies. Data availability is crucial for both the insurers and the individuals living in impacted areas. If we better understand the impact of climate change, we can better prioritise the deployment of resource through strategic investments.

For more in depth perspectives on climate finance and the importance of adaptation, take a look at the BlueOrchard Academy’s recent paper: ‘Rethinking Climate Finance – Taking Action against Climate Change. Opportunities and Challenges for Financial Players’