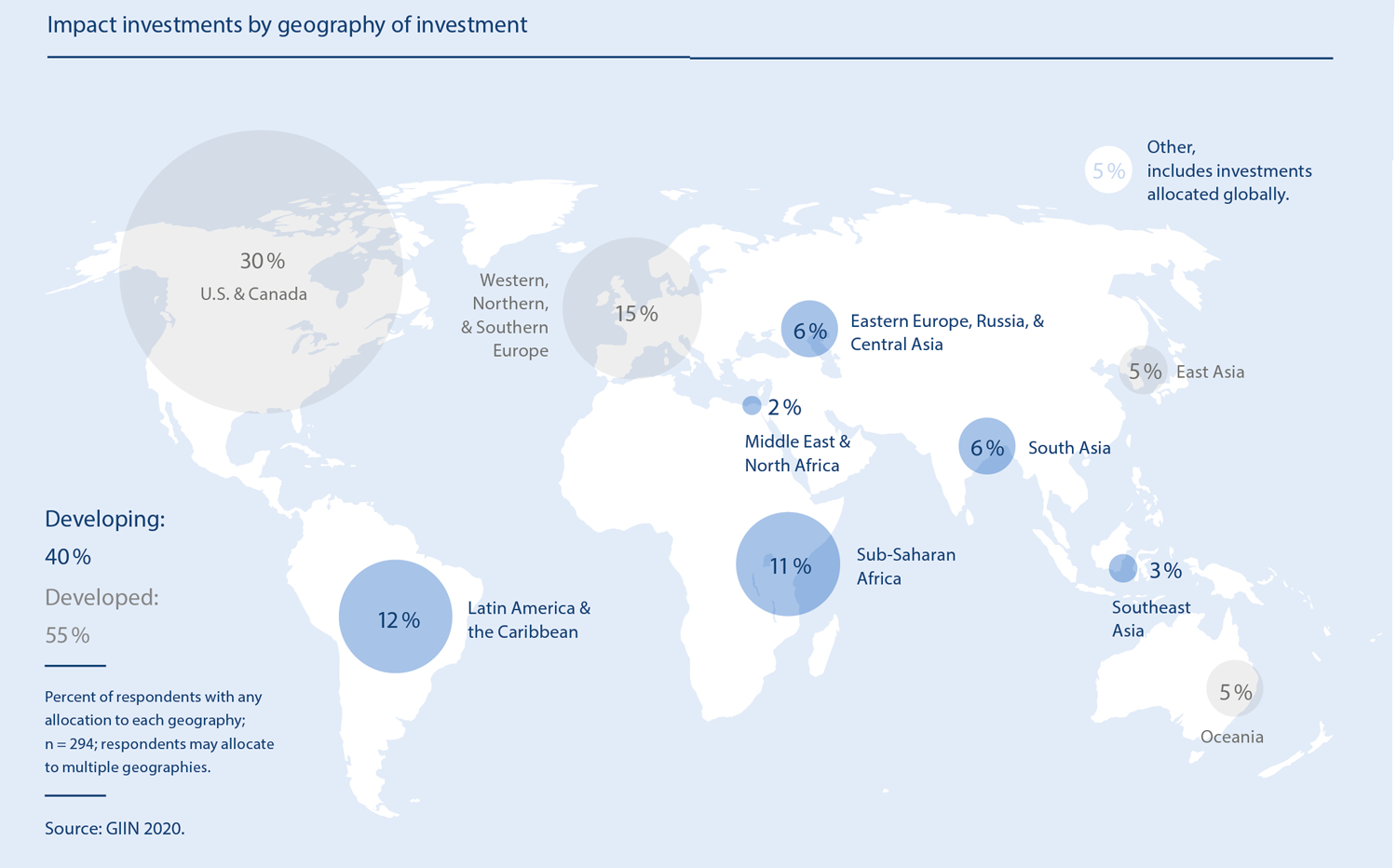

Impact investment opportunities are available globally. Investors can choose between investments in developed or developing markets, in specific regions or countries. According to the Global Impact Investing Network (GIIN), 40 % of Assets under Management (AuM) are allocated to emerging markets.

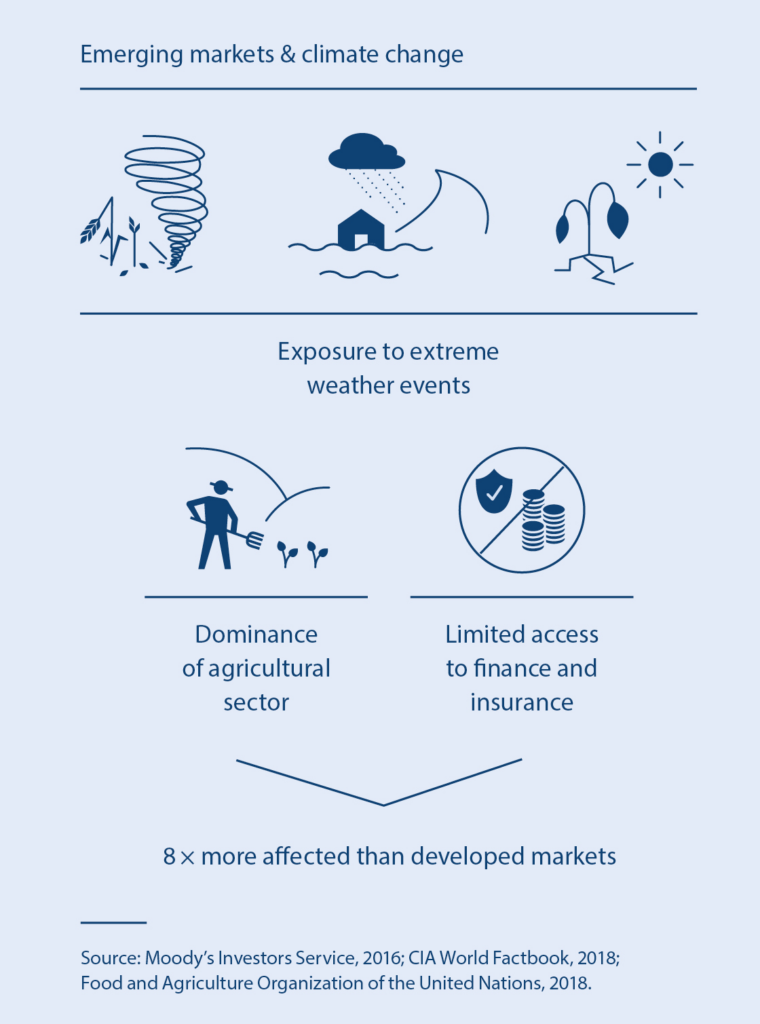

Emerging markets, for example, have a pronounced and wide-ranging need for impact investments. Around the developing world, one billion people still lack access to electricity. Emerging markets suffer eight times more from the effects of climate change than developed markets. Because of their geographic location, the dominance of the agricultural sector in many countries and a lack of access to savings, insurance, and other financial products, developing countries are less resilient and more exposed to extreme weather events that are linked to climate change.

Despite these challenges, emerging markets still show strong population and economic growth outlooks. There are more than five billion people living in developing countries, with population growth continuing at a fast pace. Emerging markets will grow more than 10 % between 2020 and 2030: notably, Sub-Saharan Africa’s population is projected to double by 2050. Emerging markets are forecasted to account for 63 % of world GDP in 2023. This creates considerable demand and in particular opportunities for impact investments.

There is a common misconception that investments in developing countries fail more often than comparable investments in developed markets. And while developing countries present unique and considerable risk factors and barriers to entry, the returns and social reach of investments in the developing world are considered more attractive.

There are, however, ample impact investment opportunities in developed countries as these countries also face major challenges with regards to social and environmental necessities. Areas of impact investments are, for example, community development, affordable housing, health, education, and sustainable infrastructure.