The world at large faces a massive array of challenges to economic and social development. Impact investing is an innovative way of combining the power of global capital markets with the drive to reduce poverty, inequality, and climate change, among other pressing concerns.

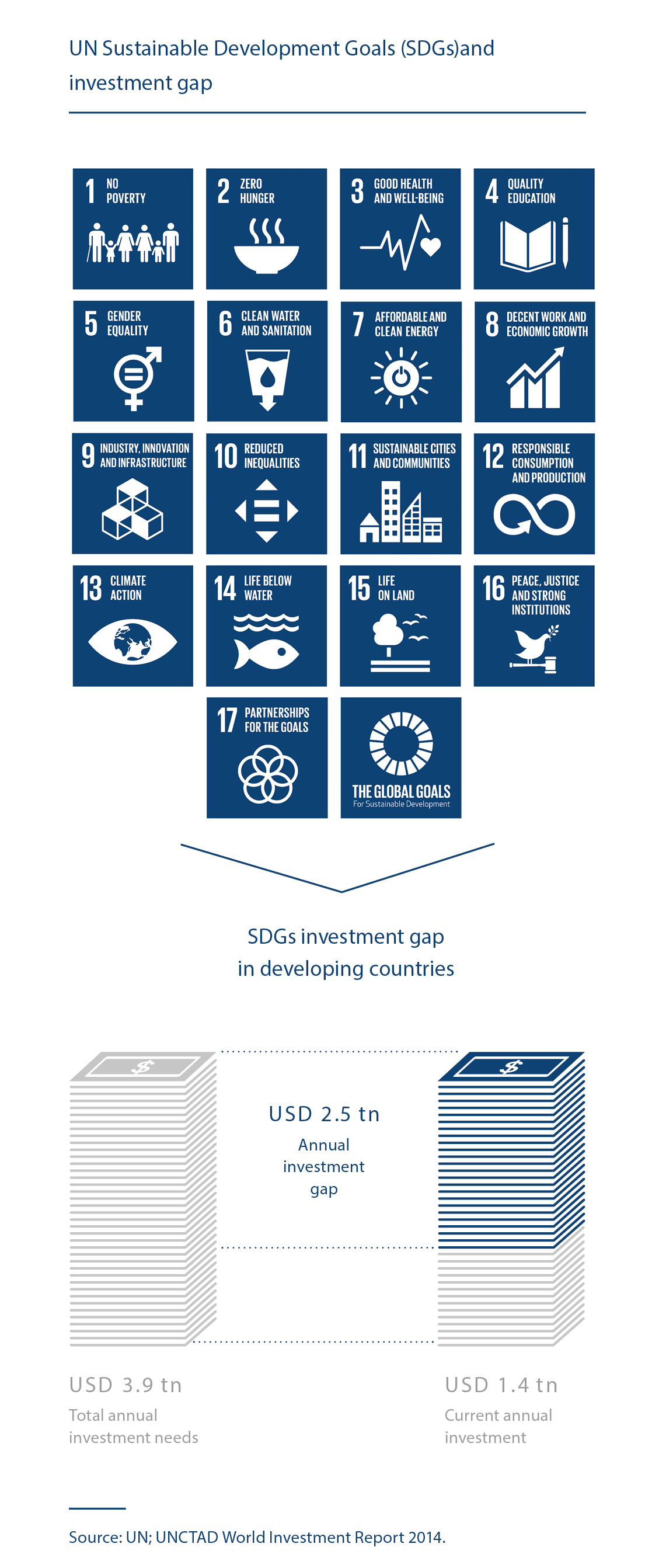

In this context, the United Nation’s Sustainable Development Goals (UN SDGs) have become a ‘north star’ of sorts for impact investment stakeholders around the world. The SDGs call for global action amongst governments, businesses, and civil society to end poverty and create a life of dignity and opportunity for all.

To fulfil the SDGs by their target date of 2030, there is an investment need of approximately USD 5 to 7 trillion per year. In developing countries alone, there is an annual financing gap of USD 2.5 trillion between current funding and what is required to meet the goals. The consequences of the Covid-19 pandemic are not even included in these figures. It is abundantly clear that government financing cannot, by itself, fix these problems. Private capital is not only relevant, it is essential to achieving the SDG objectives.

Within the realm of private capital, philanthropic sources can only fill a part of the overall finance required to meet these SDGs. The private sector, therefore, has a key role in mobilising and increasing investments.

In an age of 24 hour news and connectivity, there has never been greater awareness of the challenges and concerns facing the societies

and economies of the world. This vastly increased awareness is a major factor in the growth of impact investing as a concept. Today, a new generation of investors which includes a historically high proportion of women, millennials, and ethnic/cultural diversity seeks not only financial returns, but also the chance to use their resources to make a positive contribution and remodel industries in a more sustainable, accountable, and responsible context. People are rejecting the idea that investments cannot be made in accordance with personal and social value systems and the global markets are taking notice.

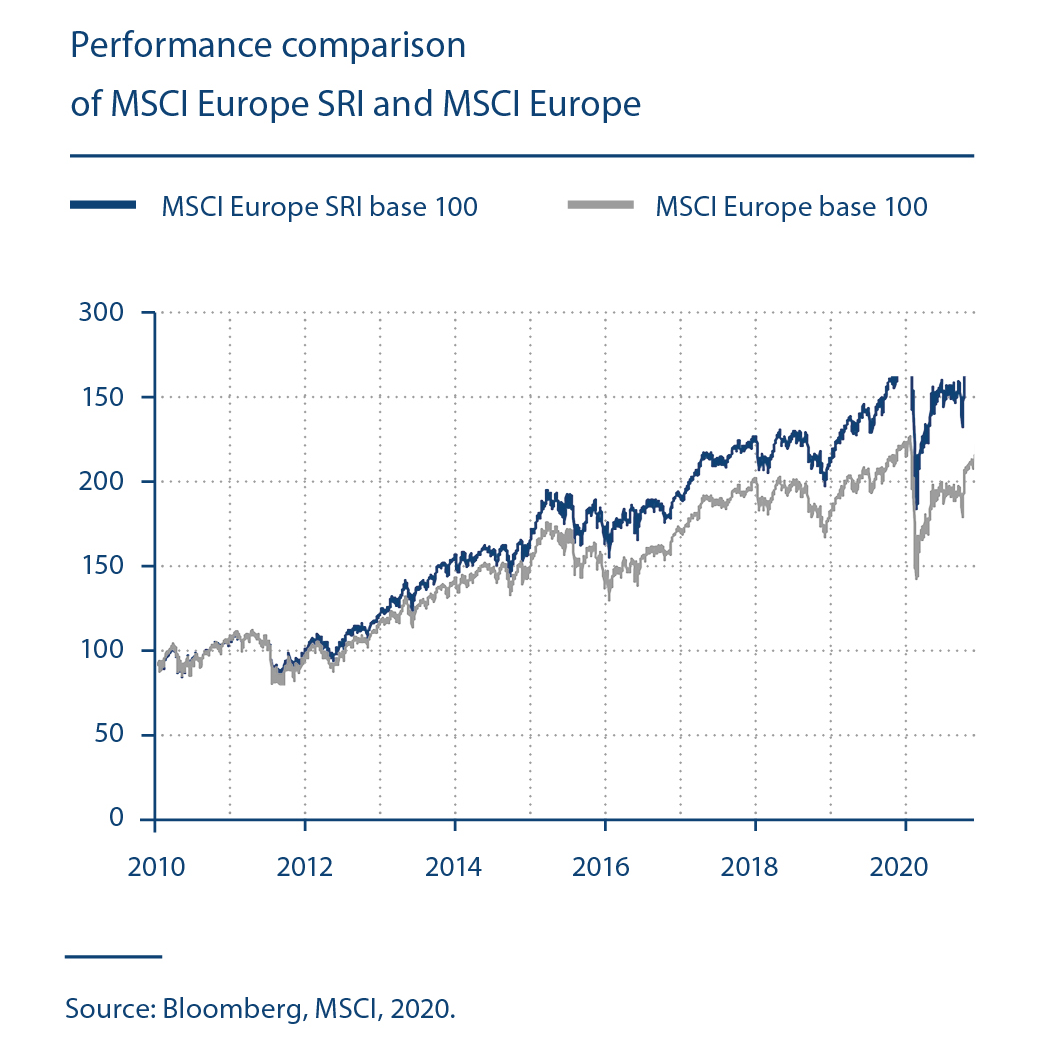

Investors need to balance risk and impact with financial return. Evidence developed over the past 20 years consistently shows that impact investing can generate positive return alongside tangible social and environmental benefits. Correlation between sustainable and impact investing and financial performance has been tested, demonstrating affirmative synergies across risk, return, and impact metrics. Looking at equity markets, for example, over the past 10 years, the MSCI Europe SRI has substantially outper

formed its traditional assets sister MSCI Europe (see chart 3).

Historically, the focus of impact investments has been on areas that are traditionally not accessible via public markets. Low volatility and low correlation between private markets and more traditional asset classes made impact investing

an attractive diversification option.

At the same time, governments are increasingly offering incentives and favourable regulatory environments, which aim at scaling up impactful investments. One of these is, for example, the European Union’s taxonomy regulation for sustainable investments (EU taxonomy), which is meant as an enabler for the implementation of the European Green Deal, a set of European policy initiatives to make Europe climate neutral by 2050 and reduce greenhouse gas (GHG) emissions. Another example of increased regulatory activities is the EU’s Sustainable Finance Disclosure Regulation (SFDR), which aims to provide more transparency and standardisation in order to prevent greenwashing and ensuring comparability. Amongst other things, it classifies products along with their investment approach, from sustainable themed investments over ESG integration to impact investing. Products promoted as ESG or impact investing are then required to be classified under a specific SFDR article.

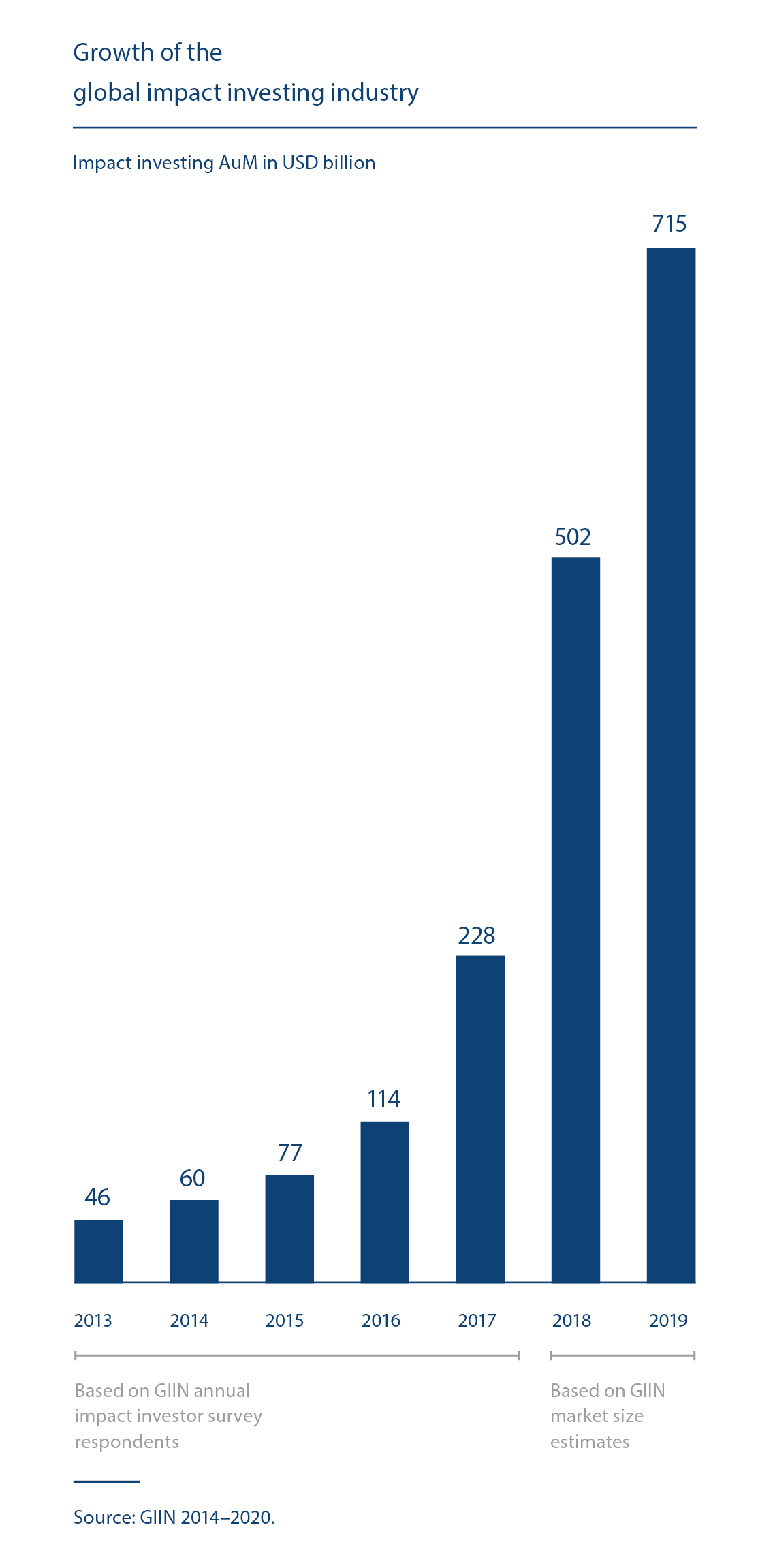

It is therefore no surprise that the size of the impact investing industry has quadrupled in the past years (see chart 4). Both retail and institutional investors, such as pension funds, insurance companies, banks, family offices, foundations, and religious institutions, are significantly increasing their allocations to impact investments. This growth is also a result of the increased availability of attractive impact investment opportunities across all asset classes. Today, the industry has reached a size that enables the absorption of large investments, supporting the investment appetite and commitment of institutional investors in the private sector.