The term ‘impact investing’ describes an approach to investing that enables investors to seek a social and/or environmental impact alongside a positive financial return. Whilst the popularity of impact investment has increased vastly in recent years, the concept is not new. What started as primarily the purview of development finance institutions (DFIs), has emerged in the private sector through the rise of the ‘microfinance’ sector and the effort to use private capital to expand financial inclusion in the world’s emerging markets. Since then, the concept has expanded into a range of asset classes including debt, equity, and structured products and seeks to bring a private market approach to solving critical challenges of global development.

Impact investing challenges the traditionally held belief that financial returns and social and/or environmental impact are mutually exclusive. The core principle behind an impact investment strategy is the idea that investments can simultaneously achieve financial return for capital providers and contribute value in communities where those investments are placed. These two critical elements work in a complimentary fashion, reinforcing each other and serving a broader purpose.

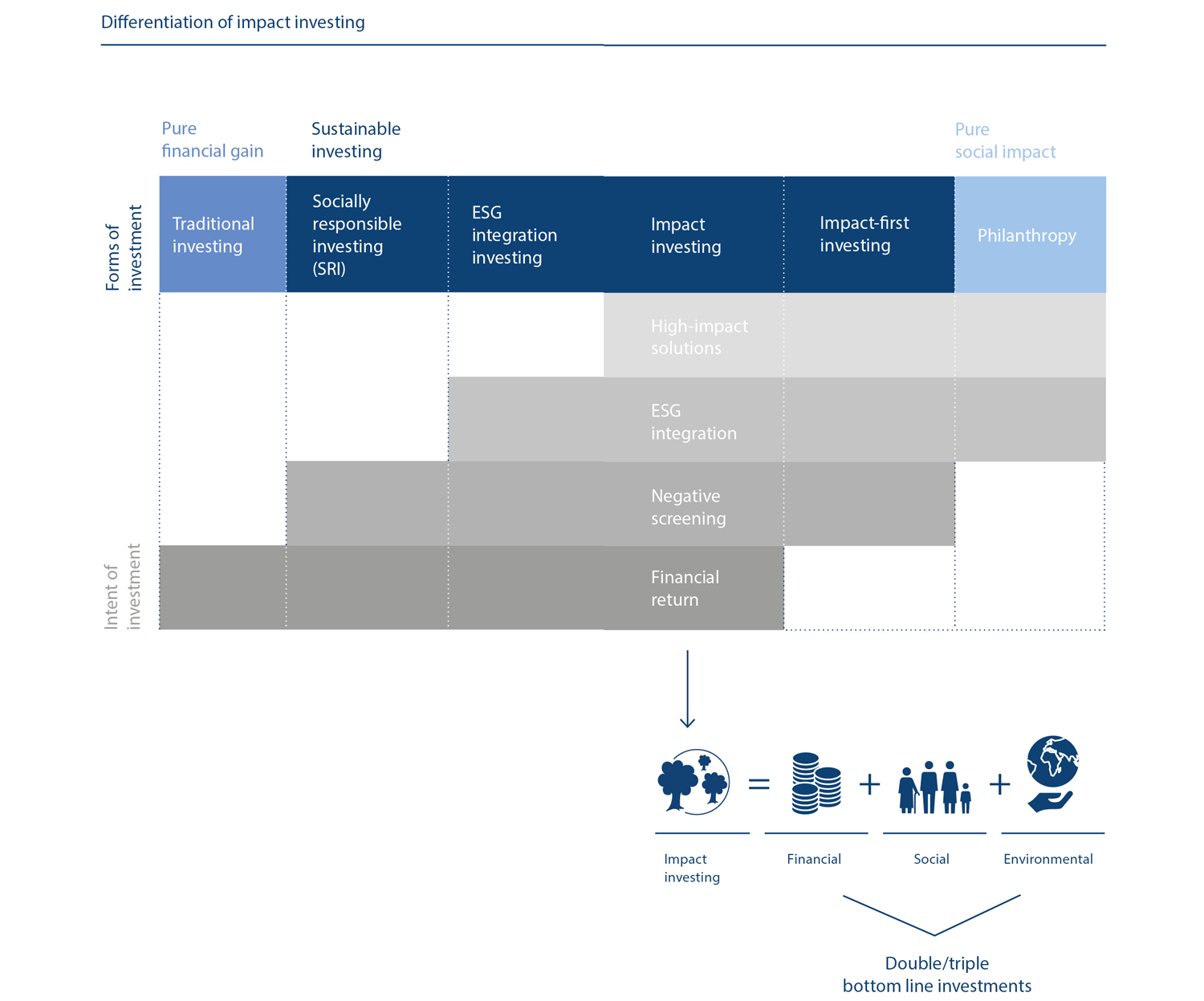

Often, the terms ‘impact investing’, ‘socially responsible investing’ (SRI), and ‘ESG investing’ (environmental, social, and governance) are used synonymously, although these approaches differ from each other at a decisive point: In simple terms, SRI and ESG investing are about the application of exclusion and inclusion criteria and focus on the conduct and governance of the company in which funds are being invested.

Impact investing, on the other hand, is the conscious and intentional decision to invest in order to achieve a previously defined, measurable social and/or environmental objective alongside a financial return. In the impact investment sector, this concept is commonly known as the ‘double/triple bottom line’ approach.